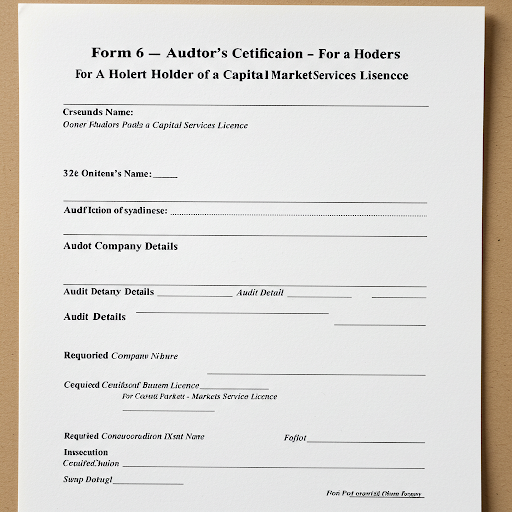

Form 6 - Auditor’s Certification - For a Holder of a Capital Markets Services Licence

- a22162

- Mar 4

- 3 min read

Singapore CMS Licence Auditor Form

Form 6 - Auditor’s Certification - For a Holder of a Capital Markets Services Licence

When dealing with "Form 6 - Auditor’s Certification - For a Holder of a Capital Markets Services Licence" in Singapore, it's crucial to understand that this pertains to regulations set by the Monetary Authority of Singapore (MAS). Here's a breakdown of key points:

Purpose:

This form is used by Capital Markets Services (CMS) licensees to submit their auditor's certifications regarding their audited financial statements.

It's a regulatory requirement to ensure financial transparency and compliance.

Regulatory Authority:

The MAS is the governing body that oversees these regulations.

Key Information:

This form must be submitted within five months from the end of the financial year.

The form is related to the Securities and Futures (Financial and Margin Requirements for Holders of Capital Markets Services Licences) Regulations.

Financial institutions are required to complete and submit this form online through the MAS-Tx platform.

Where to find the form:

The official source for this form is the MAS website. You can find it within the "Regulation" section, specifically under "forms and templates".

More Comprehensive Understanding

Let's delve deeper into the specifics of "Form 6 - Auditor’s Certification - For a Holder of a Capital Markets Services Licence" in Singapore, focusing on the regulatory context and practical implications:

Key Regulatory Context:

Securities and Futures Act (SFA):

This is the primary legislation governing capital markets activities in Singapore. Form 6 is a component of the regulatory framework established under the SFA.

Securities and Futures (Financial and Margin Requirements for Holders of Capital Markets Services Licences) Regulations:

These regulations provide detailed rules on the financial soundness of CMS licensees. Form 6 serves to ensure compliance with these financial requirements.

Monetary Authority of Singapore (MAS):

The MAS is the central regulatory authority. Its role is to oversee the financial sector, maintain stability, and protect investors. Form 6 is a tool used by the MAS to monitor the financial health of CMS licensees.

Practical Implications:

Auditor's Role:

The auditor plays a crucial role in verifying the accuracy and reliability of the financial statements submitted by the CMS licensee. Their certification provides assurance to the MAS.

MAS-Tx Platform:

The requirement to submit Form 6 through the MAS-Tx platform highlights the MAS's emphasis on electronic submission and efficiency. This system streamlines the regulatory process.

Financial Reporting Requirements:

CMS licensees must adhere to strict financial reporting standards. Form 6 is a key part of this reporting obligation, ensuring transparency and accountability.

Compliance and Risk Management:

Form 6 is used to help the MAS to monitor the capital adequacy of the financial institutions. Therefore it is a part of risk management.

Therefore, if you require the most accurate and up-to-date version of Form 6, it is essential to refer directly to the official MAS website.

Where to find updated information:

Always refer to the official MAS website for the most current version of Form 6 and related regulations.

How Bestar can Help

Bestar is a corporate services provider in Singapore that offers assistance with various business-related processes, including licensing. Here's how we can help with matters related to Capital Markets Services (CMS) licenses:

Licensing Assistance:

Bestar can assist companies in navigating the complex process of obtaining a CMS license from the Monetary Authority of Singapore (MAS). This includes:

Preparing the necessary documentation.

Assisting with the application process.

Providing guidance on meeting MAS requirements.

Representing clients in discussions with the MAS.

Company Incorporation:

For companies seeking a CMS license, Bestar can facilitate the incorporation of a company in Singapore, which is a prerequisite for obtaining the license.

Compliance Support:

Understanding and adhering to MAS regulations is crucial for CMS licensees. Bestar offers services to help companies maintain compliance.

General Corporate Services:

Beyond licensing, Bestar provides a range of corporate services, which can be beneficial for businesses operating in Singapore.

In essence, Bestar aims to streamline the administrative and regulatory aspects of establishing and operating a business in Singapore, particularly for those in the financial services sector.

To get the most accurate and up to date information about the services that Bestar provides, visit our official website, or to contact us directly.

Form 6 - Auditor’s Certification - For a Holder of a Capital Markets Services Licence

Form for capital markets services licensees to submit their auditor's certifications on their audited financial statement. This form must be submitted ...

Comments